43+ mortgage insurance premiums tax deductible

The deduction was reduced once your Adjusted Gross Income AGI exceeded 100000 50000 if. Web A big caveat.

Free 10 Personal Tax Deduction Samples In Pdf Ms Word

Web Morgan Minutes.

. Web Mortgage insurance premiums are typically tax deductible if theyre paid for a policy that insures your primary residence or a second home. You can use this method to figure the current year. Web June 5 2019 1201 PM.

However higher limitations 1 million 500000 if married. Web The law that the president signed last Friday makes hundreds of changes. Web For 2021 tax returns the government has raised the standard deduction to.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. 109000 54500 if married filing separately The mortgage. Web The PMI policys mortgage had to be originated after 2006.

Web A taxpayer who has closed on a home equity line of credit HELOC a manufactured home or a reverse mortgage may bring you a HUD-1 closing statement. Web Chart showing how the average interest charged on fixed-rate mortgage deals has changed from 234 for a two-year deal in December 2021 to 474 on 23. Web Up to 96 cash back 100000 50000 if married filing separately Eliminated if your AGI is more than one of these.

TurboTax has to wait for the. You can use Publication 936 to help calculate. Remember the deduction is only good through tax year 2020.

Homeowners can deduct what they paid in mortgage interest when they file their taxes each year. If you rent out an extra room garage apartment or second home you may be able to deduct those. Web 2 hours agoIf youre enrolled in an eligible high-deductible health plan and make contributions to a health savings account HSA you can deduct up to 3650 7300.

Single or married filing separately 12550. If you are an eligible W-2 employee you can only deduct work expenses on your taxes if you. You can deduct amounts you paid for qualified mortgage insurance premiums on a reverse mortgage.

Web Homeowners insurance tax deductions for rental properties. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes. Second only medical expenses that exceed 75 of your.

Industry experts use this rule of thumb. The PMI deduction is reduced by 10 percent for each 1000 a filers income. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Most homeowners cant deduct home insurance premiums. Its not just the mortgage insurance premium deduction. It depends on how much youre paying and what your tax bracket is.

Married filing jointly or qualifying widow. The rule is that you can deduct a home. Mortgage Insurance Tax Deductions.

Web Read about the Mortgage Insurance Tax Deduction Act of 2017. Once your income rises to this level. So if you paid 2000 in upfront PMI premiums on Jan.

Whether you qualify depends on both your filing status and. Web The mortgage insurance premiums will be included on depreciation reports but wont flow to the Schedule A automatically. Web Many US.

Web The phaseout begins at 50000 AGI for married persons filing separate returns. Web Originally private mortgage insurance tax deductions were part of the Tax Relief and Health Care Act of 2006 and applied to PMI policies granted in 2007. Other types of insurance like fire or flood insurance also arent.

Also your adjusted gross income cannot go over 109000. Web Eligible W-2 employees need to itemize to deduct work expenses. 1 2019 you might be able to deduct 286 on.

Web You can only claim a mortgage insurance premium tax deduction if you are filing for tax year 2021 or earlier. Web First you must itemize your deductions on your tax return to deduct them from your taxable income. Web Insurance premiums.

Web Not everyone can take advantage of the deduction for qualified mortgage insurance premiums MIP.

Is Pmi Tax Deductible Credit Karma

43 Free Editable Real Estate Commission Invoice Templates In Ms Word Doc Pdffiller

Business Succession Planning And Exit Strategies For The Closely Held

Coldwell Banker Global Luxury The Report 2023 By The Report Group Issuu

Thairobbin Multiple Streamsofincome

Is Mortgage Insurance Tax Deductible Bankrate

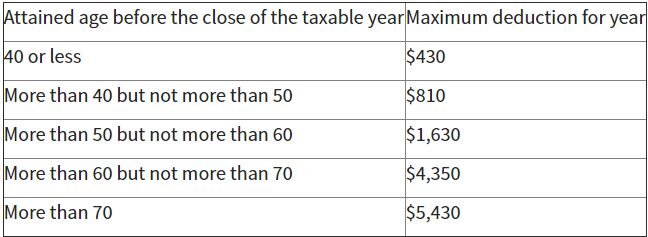

Irs Issues Long Term Care Premium Deductibility Limits For 2020 Pierrolaw

Is Private Mortgage Insurance Pmi Tax Deductible

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

6 Tax Breaks Every First Time Homeowner Should Know About

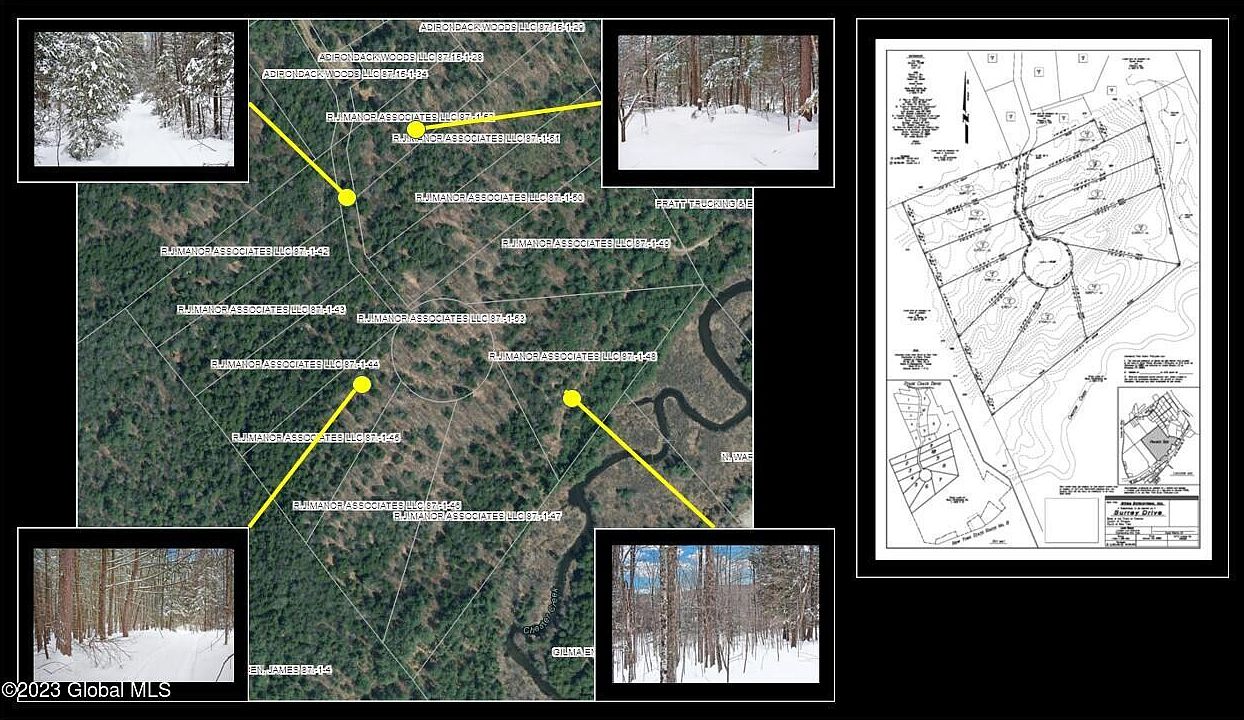

43 Ac Amber Lake Rd W 186633 First Weber Realtors

43 Ac Amber Lake Rd W 186633 First Weber Realtors

Rkrnobhlbhwf7m

Upfront Mortgage Insurance Premium Is It A Deduction

43 Free Editable Hr Budget Templates In Ms Word Doc Page 2 Pdffiller

Free 43 Sample Hr Forms In Pdf Excel Ms Word

Mortgage Broker In Port Macquarie Wauchope Laurieton Mortgage Choice